Written by Rakhesh Martyn, Head of C&I and Utility-Scale at Evergen

What is the problem with the current grid? Why do we need to stabilise it?

Modern power systems are large and complex. They operate using a mixture of direct currents and alternating currents, with AC being most common for businesses and residential consumers. If you’re interested in some of the background behind the differences between the two types of current, and why AC is more prevalent these days, there are some great books and documentaries out there on the War of the Currents (Edison v. Westinghouse) from the late 1800s. For a power system to be universally reliable and safe, there are two major characteristics that must be kept under tight control – voltage and frequency.

In the Australian National Electricity Market (NEM), network stability is the responsibility of Network Service Providers (NSPs, both Distribution and Transmission), and power system security is the responsibility of the System Operator (AEMO). These two are obviously closely linked, so it is important that NSPs and AEMO be able to accurately forecast generation and supply so that they can ensure stability and security at all times.

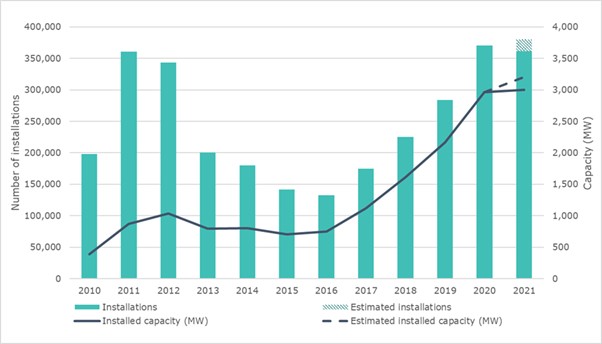

At a high level, sudden voltage deviations tend to be more of an issue for DNSPs, and sudden frequency deviations tend to be more of an issue for TNSPs and AEMO. Increases in localised voltage brought about by proliferation of behind-the-meter DERs (i.e. high rooftop solar export) have caused major concerns for Australian Distribution Network Service Providers (DNSPs) in recent years, as these lead to reductions in minimum demand and even reverse flow at various network nodes. The network infrastructure is not designed to operate under such conditions, and NSPs are powerless given that individual DERs are largely invisible and uncontrollable to them. However, this is a problem that has to be solved, as Australia’s impressive and world-leading uptake of rooftop solar continues, and battery numbers look set to keep growing too.

Supplied: Clean Energy Regulator

Front-of-meter solar and wind generation is also growing here. Given the maturity and uptake of solar, batteries and wind in Australia, AEMO’s recent ISP suggested that over-building wind and solar would be a reasonably pragmatic and cost-effective solution to retirement of legacy generation in the NEM. TNSPs and AEMO will have to solve this problem at a much larger scale too!

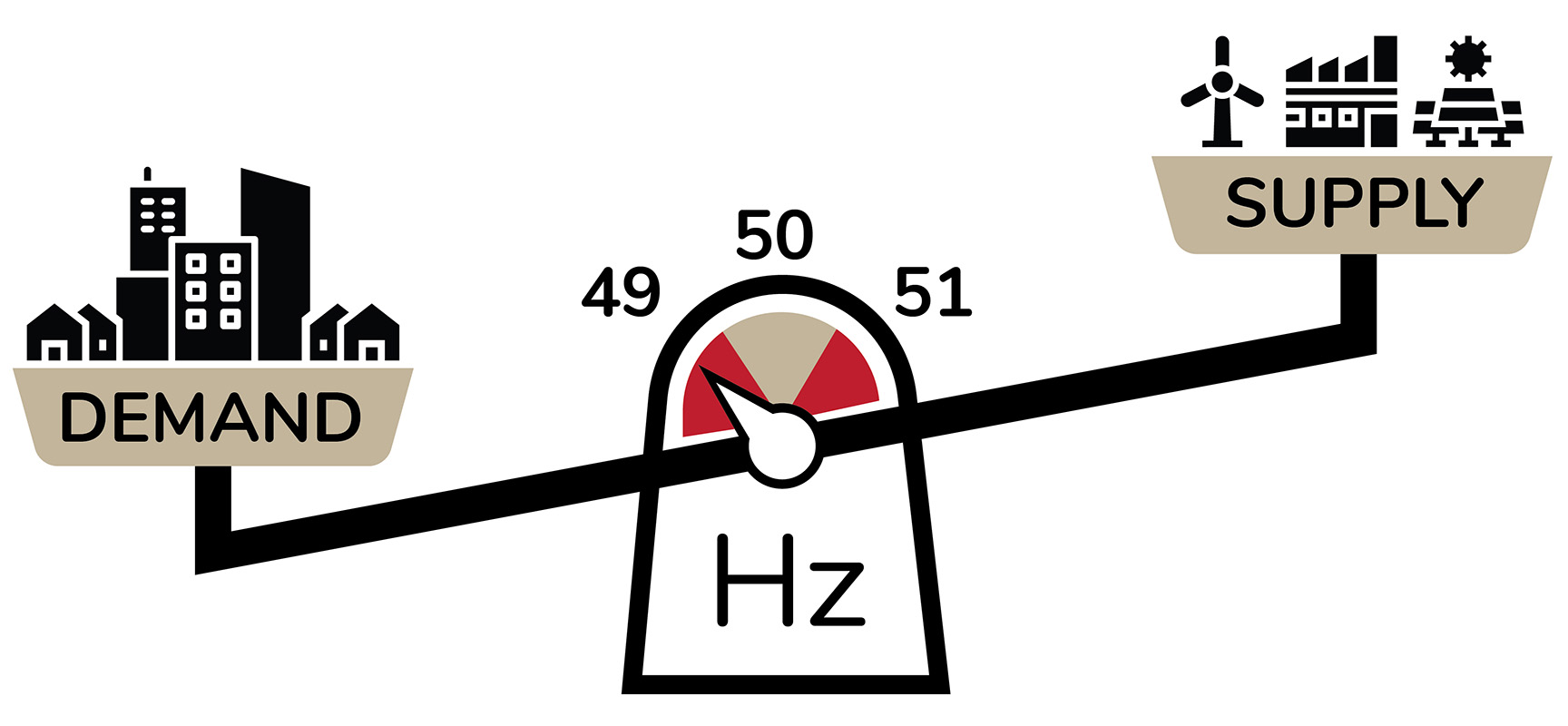

Frequency control has arguably been the most prominent issue in the NEM over the last few years. Given its size and relatively sparse population per m2, Australia’s networks have not been built with the same density as those in other countries. As a result, management of frequency is a major challenge, and it becomes more difficult as synchronous generation exits the system as these generators also provide a lot of inertia. Renewable energy sources introduce other challenges that need to be (and can be) solved too – something as simple as a passing cloud can lead to a reduction in generation of several hundreds of MW. That is a topic for another day, though.

What are grid stabilisation services?

Network and System Operators procure various services to help them manage the integrity of their areas of responsibility. These services are procured in a variety of ways across the world – year-ahead auctions, month-ahead auctions, real-time 5-minute markets etc. The goal of these services is to ensure that if grid stabilisation is required due to a sudden deviation in voltage/frequency, sufficient resources have been procured to achieve this. Contingency FCAS (Frequency Control Ancillary Services) in Australia’s National Electricity Market (NEM) is one of the best-understood versions of this. AEMO procures Contingency FCAS from eligible participants in a market that runs in a similar way to the wholesale market, with bidding and enablement occurring in 5-minute intervals. It is classified as an emergency service, expected to be used infrequently but with resources paid to be on standby continuously.

How does it work?

Continuing with Contingency FCAS as our example, sites must demonstrate their technical eligibility according to published requirements (in this case the Market Ancillary Services Specification, MASS) and register their capacity through a licensed market participant. If their registration is successful, they can submit bids and earn the clearing price alongside others delivering FCAS. If bids are accepted by AEMO, then the associated sites are available to respond to frequency deviations if they occur. Every site has a set-point at which they must begin to respond to frequency deviations, acting to arrest the deviation and return frequency to the normal operating frequency band (NOFB, 49.85Hz-50.15Hz). If frequency remains stable, those sites need not do anything different, but will still be paid.

Credit: AEMO – Energy Explained: Frequency Control

How successful have they been in Australia?

Behind-the-meter voltage control services are mostly in the research/piloting phase in Australia. Examples can be seen through the Evolve programme and the upcoming Project Symphony in WA. Utilities have been assessing the impact of aggregated DERs on network stability. These trials have been largely successful, but market design has not yet caught up with the results to make voltage stabilisation an ongoing part of the overall value stack.

However, Contingency FCAS has proven to be a real success story following changes to market rules. Major changes to voltage and frequency occur quickly when triggered and must be remedied immediately (action required within milliseconds in some cases), to avoid the possibility of blackouts. During the terrible bushfire season of 2019/20, there were many instances of interconnectors and large power stations tripping, and Contingency FCAS helped bring frequency back to the NOFB many times. A few years ago, there was a prevailing argument in the industry that AEMO was using Contingency FCAS as a means to control frequency, as there were many Contingency FCAS events (as many as 20-30 in a single year, which is very high). The introduction of Mandatory Primary Frequency Response in late 2019 seemed to have a great positive impact on frequency control generally, but Contingency FCAS continued to be a costly service for other reasons (interconnectors being out of service and large generators being out of service due to trips or catastrophic explosions being two examples).

How has Evergen worked with a client around this?

AEMO recently ran a demonstration programme to showcase the ability of VPPs to deliver Contingency FCAS. Evergen enabled Members Energy to enrol portfolios (or ‘fleets’, as we call them) in Victoria and New South Wales to participate, aggregating thousands of residential customer batteries in the process. Their customers were each optimised by Evergenat a single site level, then co-optimised for fleet benefits and FCAS using our platform’s fully-automated bidding engine to offer them into the contingency FCAS markets where possible. This included supporting the registration process, and communicating directly with AEMO when data was requested.

What services will we see roll out in the next 5-10 years?

Behind the meter, we can expect to see grid stabilisation services becoming more important and more decentralised. Electrification is occurring at pace, which means more traditional and new DERs (like electric vehicles). Management of network stability and system security amongst all of this is going to present challenges to those responsible, both more of today’s challenges and new ones that will be brought about by new technologies. NSPs and SOs will undoubtedly rely even more heavily on grid stabilisation services to steady the ship as the energy transition continues.

We can expect a similar story in front of the meter, but the challenges will be more pronounced. Retirement of legacy generation is great for the environment but has presented some challenges due to removal of inertia. The pace shows no sign of slowing though, as evidenced by Australia’s impressive pipeline of renewable and storage projects. The advent of grid-forming inverters provides some promising signs for the future.

How can we help with this new energy model?

Here at Evergen, we are already helping with the growth of these programmes by operating VPPs for DNSPs and retailers using the same customer assets. Our vendor-agnostic and cloud-native approach allows diverse fleets of assets to be enrolled and operated quickly. We are taking this capability abroad as well. If regulators can ensure that current and future incarnations of the model enable value to be shared amongst all stakeholders (most crucially the consumers and businesses allowing use of their assets to provide grid stabilisation services), that will encourage more participation, and ensure stability of grids across the world.