By Kate Reid, Regulatory Affairs Manager at Evergen

Like elsewhere across the globe, the European Union’s energy system is undergoing a profound transformation. This transformation is characterised by decentralisation, digitisation and decarbonisation and is being accelerated by geopolitical risks and disruption.

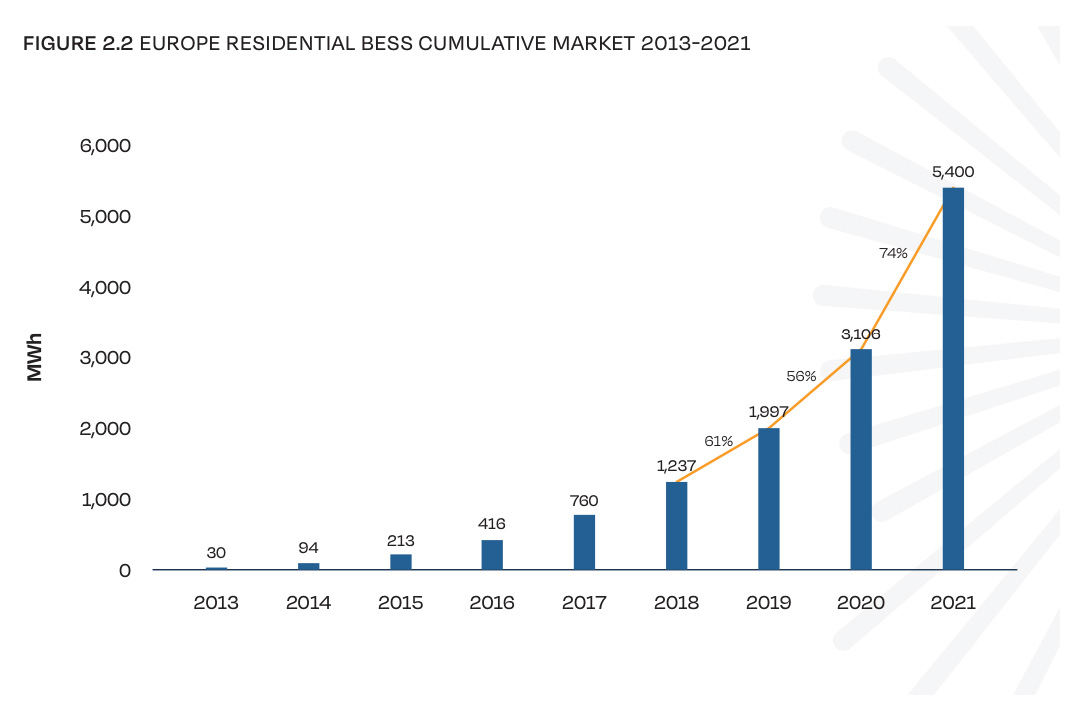

Decentralisation represents a shift away from a few, large-scale power generation facilities towards a network of small, distributed renewable energy sources. This includes solar panels on rooftops and battery storage units which are being installed by European households at record levels (as indicated in Figure below). Encouraged by government subsidies and soaring electricity prices, consumers are installing batteries to maximise self-consumption from their rooftop PV, reaching an attachment rate of 27% in 2021 (i.e. 27% of the new residential PV installations included a battery). Anecdotally this is as high as 95% in the UK at the moment.

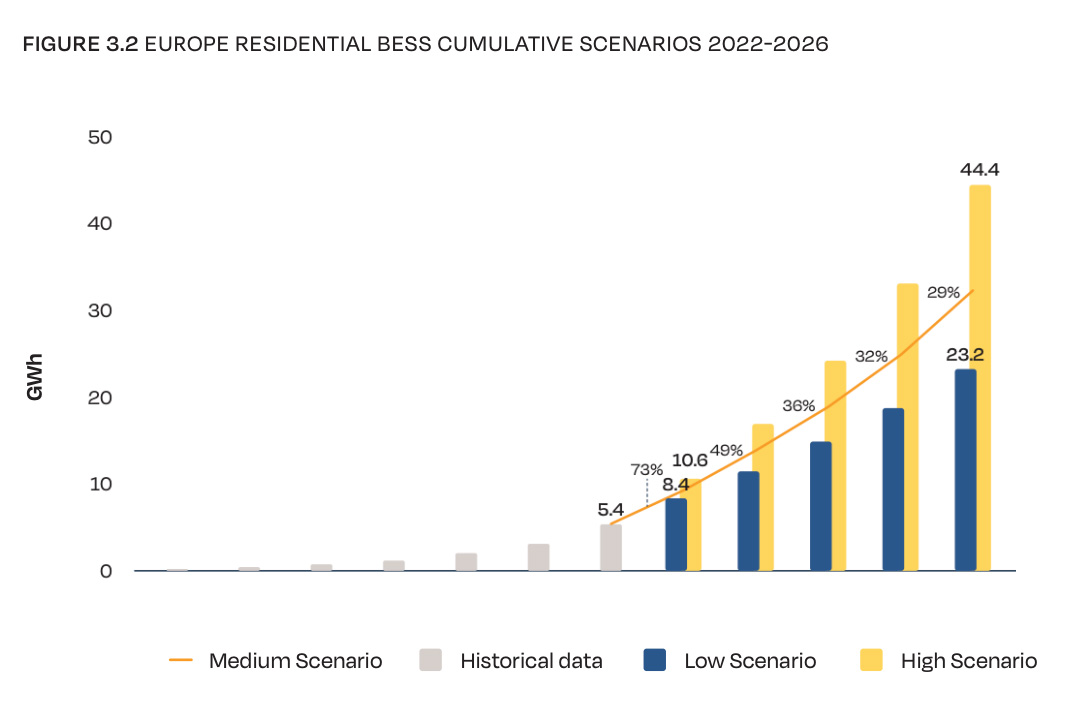

Source: SolarPower Europe – European Market Outlook for Residential Battery Storage 2022-2026

Digitisation

The digital transformation in the European energy sector is harnessing advanced technologies, including Artificial Intelligence and Machine Learning tools, to optimise energy use and manage the complexity and variability of renewable energy sources, and to ensure the smooth operation of decentralised grids.

Decarbonisation

Transitioning from traditional fossil fuel-based energy sources to renewable, low-carbon energy sources such as wind, solar, and hydro power is critical to meeting climate goals. The European Union’s ambitious targets for reducing greenhouse gas emissions, has been effective in promoting energy efficiency and increasing the share of renewable energy. Surging prices due to the Ukraine war have also seen natural gas demand in the European Union fall in 2022 by 13%, while a record high of around 50 GW of wind and solar was installed in the European Union in 2022, thanks to ongoing policy support from programs such as REPowerEU (IEA, 2023).

Flexibility is essential to a successful transition

The shift away from traditional sources of energy towards renewable energy including distributed energy resources (DER) such as rooftop solar and battery storage means there will be a growing need for flexibility to ensure a real-time effective orchestration between the electricity being generated and the electricity being consumed in the system to ensure the appropriate performance of the transmission and distribution networks while minimising the electricity costs for system operators and ultimately final consumers. Consumers on the demand side will provide some of this flexibility.

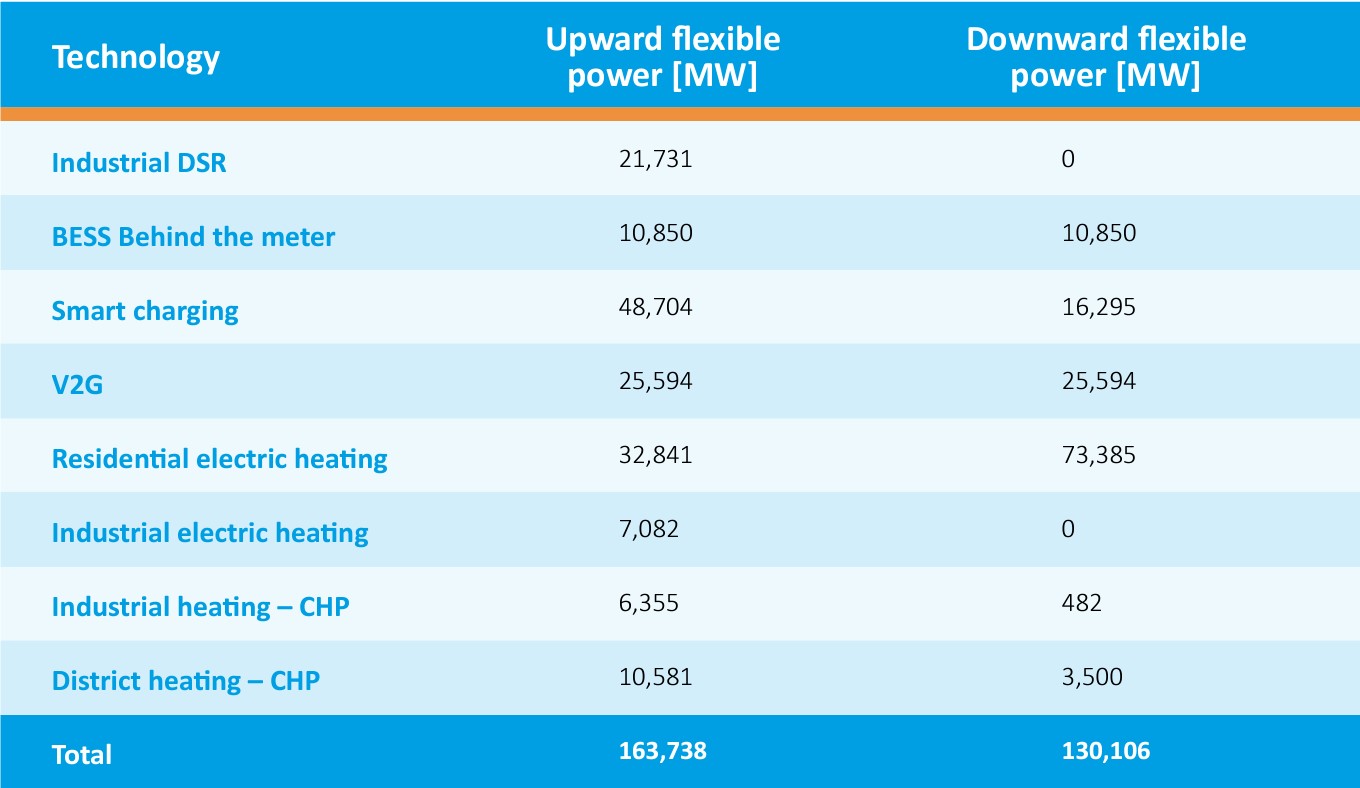

The magnitude of the potential for demand-side flexibility in Europe by 2030 was recently modelled by the association smartEn and the consulting company DNV in a study published last September. With a forecasted peak load of 752 gigawatts (GW) in the 27 states of the EU in 2030, flexible capacity could account for about 20% of it (smartEn, 2022).

Source: SmartEn, Demand-side flexibility in the EU: Quantification of benefits in 2030, September 2022.

The right incentives, market mechanisms and innovative service offerings are necessary to motivate consumers to provide flexibility using their hot water, electric-vehicles, behind-the-meter storage and heating and cooling systems. Fortunately, the market reforms taking place in Europe combined with enabling energy management technologies is making it possible for energy suppliers to collaborate with their customers and mutually benefit from providing flexibility to the system.

EU electricity market reform

The European Commission (EC) has progressively been putting in place measures to encourage demand side flexibility. Different shades of time-of-use and dynamic tariffs are widely available across Europe thanks to the EU introducing a directive that all EU states must implement dynamic pricing into national law by 2025.

The implementation of dynamic pricing is crucial for influencing consumption habits to correspond with the real-time generation of power. This is advantageous for both those who consume electricity and those who supply it. When energy companies introduce flexible pricing, they motivate users to utilise electricity when the sun is shining or wind is blowing, rather than during customary peak times. This can potentially diminish the requirement for capital expenditure in supplementary power generation, distribution, and associated costs.

The role of the demand response and the Independent Aggregator was also formalised in the EU Directive 2019/944. According to the EC, Independent Aggregators have now been recognised in the national legislation of 19 Member States. This paves the way for innovative new market participants to bundle DERs and create Virtual Power Plants (VPPs) of a sizeable capacity that becomes eligible to participate in wholesale, balancing and capacity markets.

In March of this year, the European Commission put forward a further package of measures in a proposal to encourage the use of flexible resources (in gigawatts) on the demand side and to unlock their potential for flexibility (in gigawatt-hours). The European Parliament has now voted in favour of the package which sends a clear signal about the value of flexibility.

In an effort to enhance power system flexibility, Member States will be obligated to evaluate their requirements and set goals for increasing non-fossil fuel flexibility. They will also have the opportunity to implement new support programs, specifically focusing on demand response and storage. Additionally, system operators are empowered to obtain demand reduction during peak hours. Alongside this package, the Commission also provided recommendations to Member States regarding the development of storage innovation, technologies, and capacities.

Echoes of Australia’s energy transformation

The journey that Europe is on is very similar to the one already experienced in Australia. The National Electricity Market (NEM) in Australia has experienced significant changes in recent years, driven by a high penetration of renewables and an increasing deployment of DER such as rooftop solar PV and battery storage systems.

Out of necessity Australia has been pioneering ways of managing a system characterised by high levels of renewables and distributed energy. In response to the shift to consumer driven distributed energy, governments, market bodies, system operators, industry and consumers have undertaken numerous trials exploring dynamic tariffs, demand response and aggregation as a tool for managing electricity supply and demand in the NEM.

These trials have demonstrated the ability of DER to provide flexibility services and prompted the implementation of a number of market reforms. New innovative services and business models, including Home Energy Management Systems (HEMS) and VPPs, have emerged as a result and are now reaching scale and maturity in Australia.

How can Evergen help?

For Evergen, all of this presents opportunities – our ability to integrate to virtually any DER without additional hardware means we can collect streams of data from almost any device to deliver insights, optimisation and orchestration for energy suppliers and their customers, in any given market.

By predicting energy needs and market conditions, Evergen optimises and orchestrates mixed DER assets (PV, batteries, EV chargers, hot water systems). This means energy suppliers, leveraging Evergen’s advanced analytics and energy management software, can offer services to their customers that go beyond the traditional sale of kWh and generate benefits for both the supplier and the customer while supporting the grid. This is good news for everyone!

References:

Clean Energy Council, Clean Energy Australia Report 2023, April 2023.

European Commission. (2023). Energy Storage – Underpinning a decarbonised and secure EU energy system (SWD(2023) 57 final) . Brussels.

International Energy Agency (IEA), Europe’s energy crisis: What factors drove the record fall in natural gas demand in 2022?, March 2023.

SmartEn, Demand-side flexibility in the EU: Quantification of benefits in 2030, September 2022.

SolarPower Europe, European Market Outlook for Residential Battery Storage 2022-2026, December 2022.