Written by Dr Jonas Dias, Head of Data Science, Evergen.

How demand charges work in Australia and how Evergen can help.

Imagine being billed for how fast you drink your beer.

Imagine there is a new pub in town. It charges you by the volume of beer you consume, but during certain times (usually in the evenings), when it gets crowded, it also charges you by how fast you drink. The glass you downed the fastest dictates how much extra you will pay for that month. Even if that’s the only glass of beer you drink, you will be billed at that maximum rate for the whole month. Or, depending on where you are, you could be billed at the pace you drank that beer for the whole year!

That’s how an electricity bill with demand charges works. You pay for the “volume” of energy you consume (the dollars per kWh) but also by the demand (the dollars per kVA or kW). The monthly demand charge is (typically) set (in Australia) by the 30-minute interval when you have had the maximum demand.

So you may say, “I can drink slower during those expensive periods” or, even better, “I can store that beer in my fridge and drink it later at my preferred pace.” That’s right! Historically, electricity users have been using strategies like load-curtailment or load-lopping to reduce demand charges. Using your house as an example, you could avoid turning on your heater, microwave and washing machine at the same time.

The strategies mentioned above are still viable methods to use but are becoming increasingly inconvenient for those with discretionary load and are not an option for those with essential loads. However, you can achieve the same outcome with on-site energy storage like a battery.

Instead of “drinking” power from the grid, pour it from the battery. Even if it can’t reach the power level to supply your demand fully, it still reduces how much you drain from the grid.

What is more valuable, though… consuming less energy when prices are higher, or avoiding peak demand charges?

Evergen designed Intelligent Control (IC) software to reduce your electricity costs. One of its capabilities is to co-optimise energy arbitrage and demand charge avoidance, aiming at making the best financial use of your battery. For example, on an overcast day, IC may decide to pre-charge your battery at night to have enough energy to supply you when energy prices are high. The impact of this strategy at the meter is a shift in consumption from expensive hours to cheaper hours. Therefore, we call it ‘load-shifting’.

When we add demand charge avoidance, IC needs to co-optimise between the two. There are scenarios where the optimisation of one aspect helps optimise the other. In other words, when you increase load shifting, you can reduce demand charges at the same time.

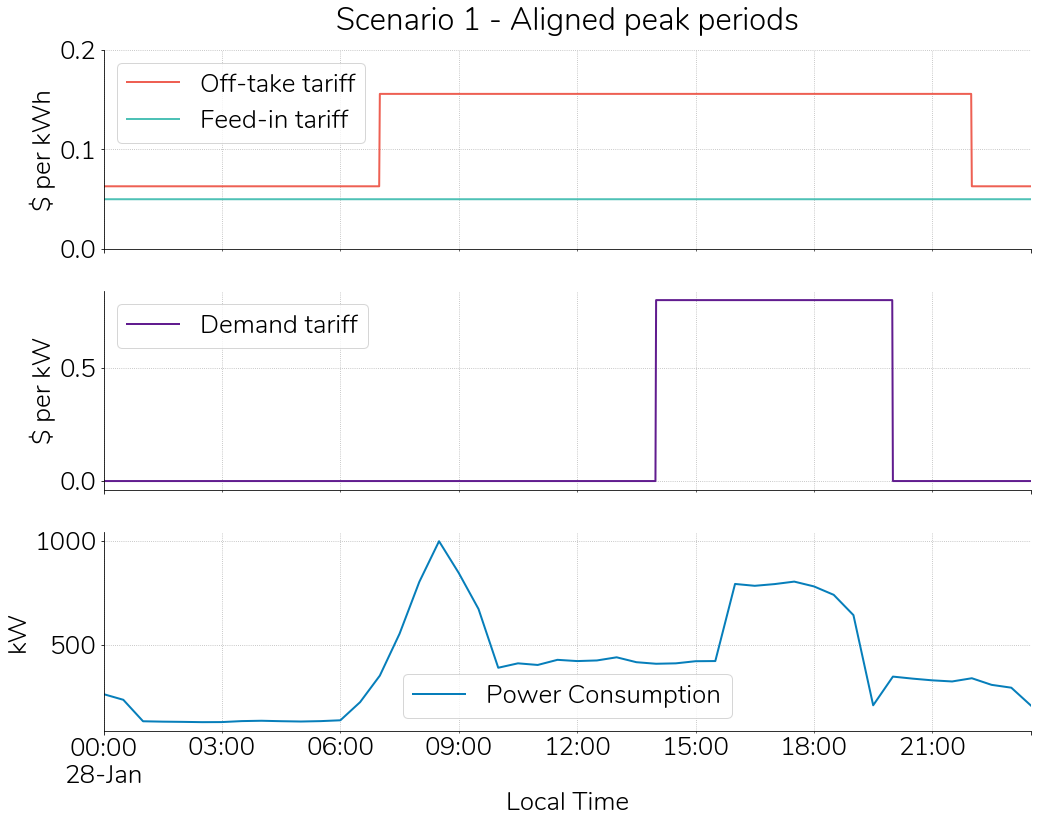

As an illustration, consider the scenario in the figure here. It’s one day of a commercial site that has a peak demand tariff between 2pm and 8 pm (the purple line in the second chart), which is when the tariff to buy energy from the grid (off-take tariff) is also at its peak (between 7 am and 10 pm; the red line at first chart). The blue line on the bottom graph illustrates power consumption (in kW).

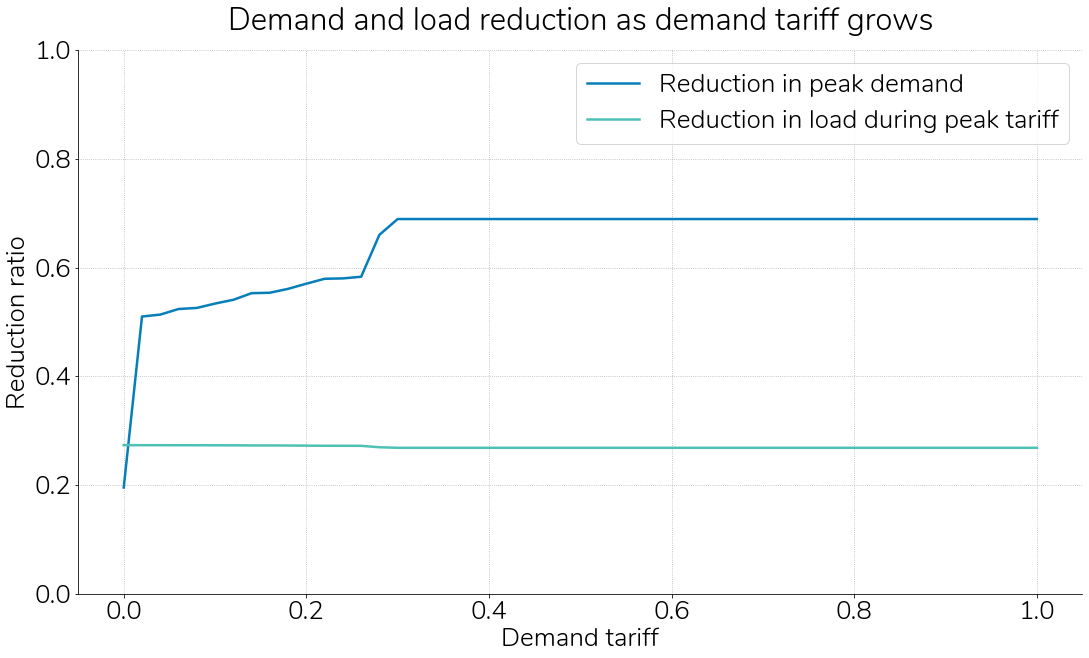

The optimal plan for this scenario will move consumption to off-peak periods and simultaneously reduce peak demand. To demonstrate the trade-off between load shifting and peak demand avoidance, we ran Evergen optimisation multiple times, increasing the cost of the demand tariff from $0 to $1 per kW per day. As you can see in the chart below, the optimisation doesn’t need to sacrifice too much load shift to reduce peak demand.

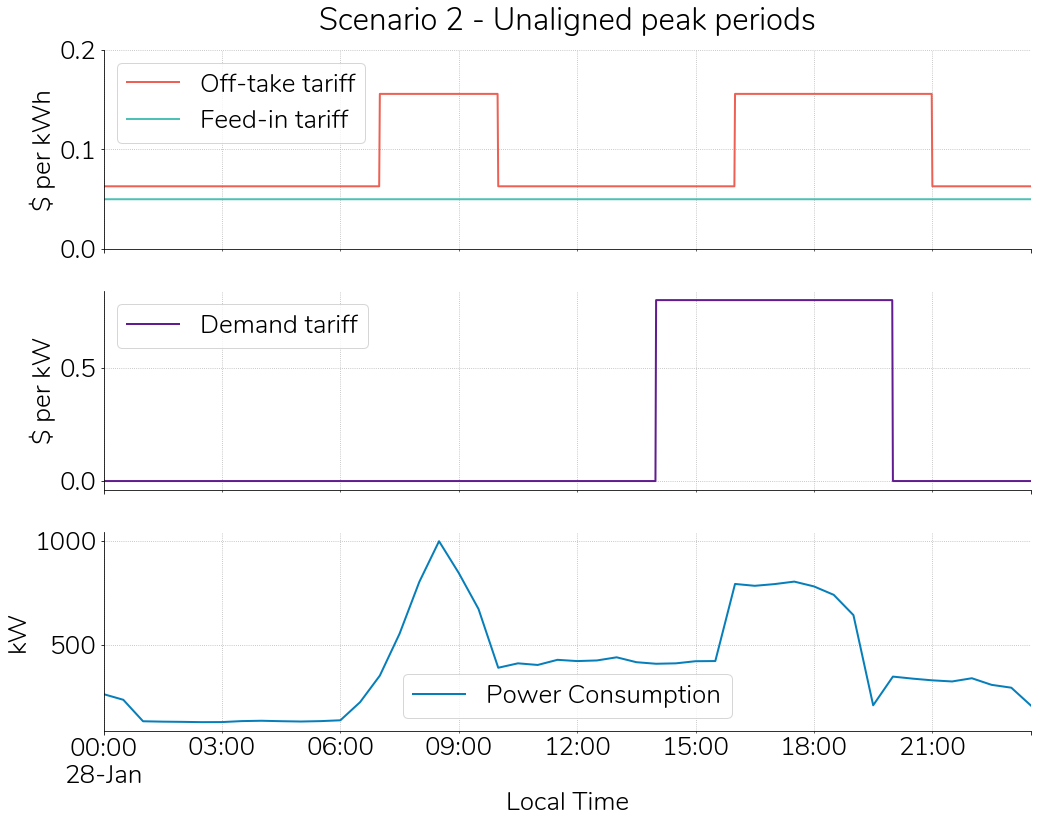

The picture here draws another possible scenario. In this example, the peak demand and off-take energy tariffs don’t align. Meaning the optimisation needs to make choices, searching for the sweet spot that minimises the overall costs.

The picture here draws another possible scenario. In this example, the peak demand and off-take energy tariffs don’t align. Meaning the optimisation needs to make choices, searching for the sweet spot that minimises the overall costs.

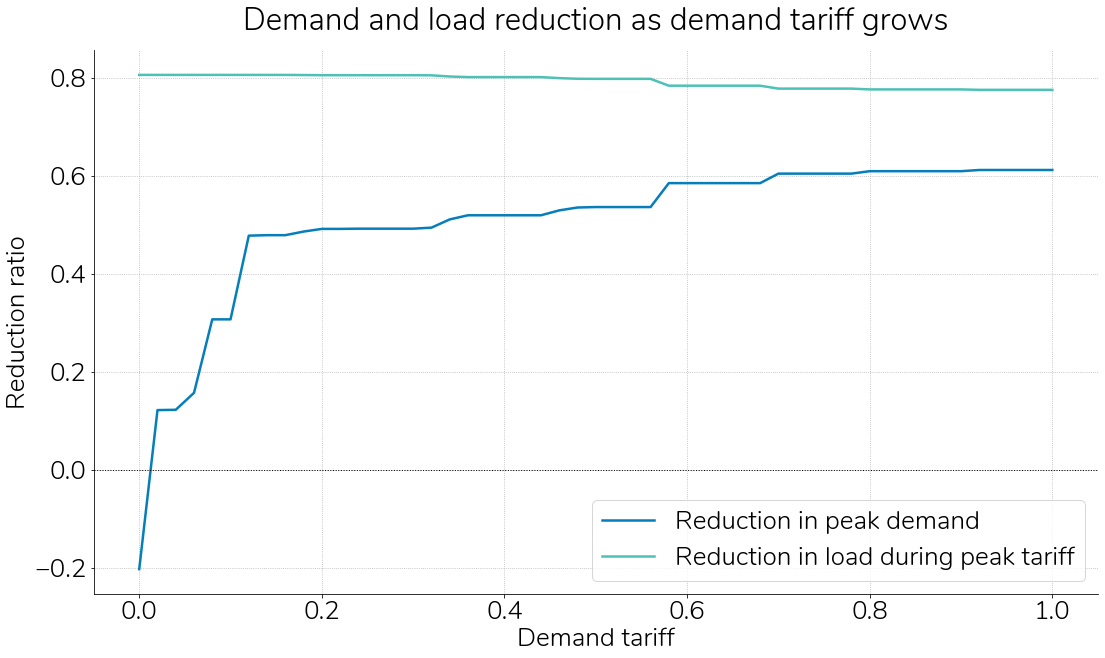

The updated results are in the graph here. When the demand tariff is close to zero, the optimisation increases demand (the negative reduction) to improve load shifting. As demand becomes expensive, the optimisation starts to sacrifice load shifting to flatten consumption during peak demand hours. Note that there is still an overlap between the tariffs. The overlap lets the optimisation reduce both costs. However, when the overlap is over, the optimisation still needs to choose what is more cost-effective.

The latest scenario we tested has the same peak demand hours as the previous ones. Also, the consumption curve is the same. However, the site is facing the wholesale market to trade energy.

Since Evergen IC can also optimise against spot prices, it can profit in the market by storing cheap energy and using it (or selling) later when prices are higher. On average, the savings margin for sites exposed to the wholesale market is higher than for sites under time-of-use (ToU) tariffs. However, there is more risk involved as well.

Minimising demand charges is a safe investment, whereas spot trading brings risk. This is because the demand tariffs won’t change based on external factors, but the wholesale market volatility is hard to predict. Take for example the risk of creating a demand peak in anticipation of a forecasted high wholesale price that does not eventuate.

Demand peaks may create a loss for an entire year. Even though several network service providers reset their maximum demand measurement every month (or after a few months), some use the maximum value over the whole year. For instance, even if your typical demand is below 1MW, if you have a striking peak of 2MW today, you will pay the demand charge for 2MW for twelve months.

The American actor Tom Selleck (aka Magnum P.I.) once said, “risk is the price you pay for opportunity”, and that is also true for the energy market. If we are very restrictive with demand avoidance, we may lose opportunities. It is well known that selling energy from a large battery when the price spikes can yield thousands of dollars in a short period of time. Hence, we must balance risks and benefits when managing assets under complex tariff structures.

Evergen Intelligent Control has a solid mathematical framework to help you automate this cornerstone decision-making.

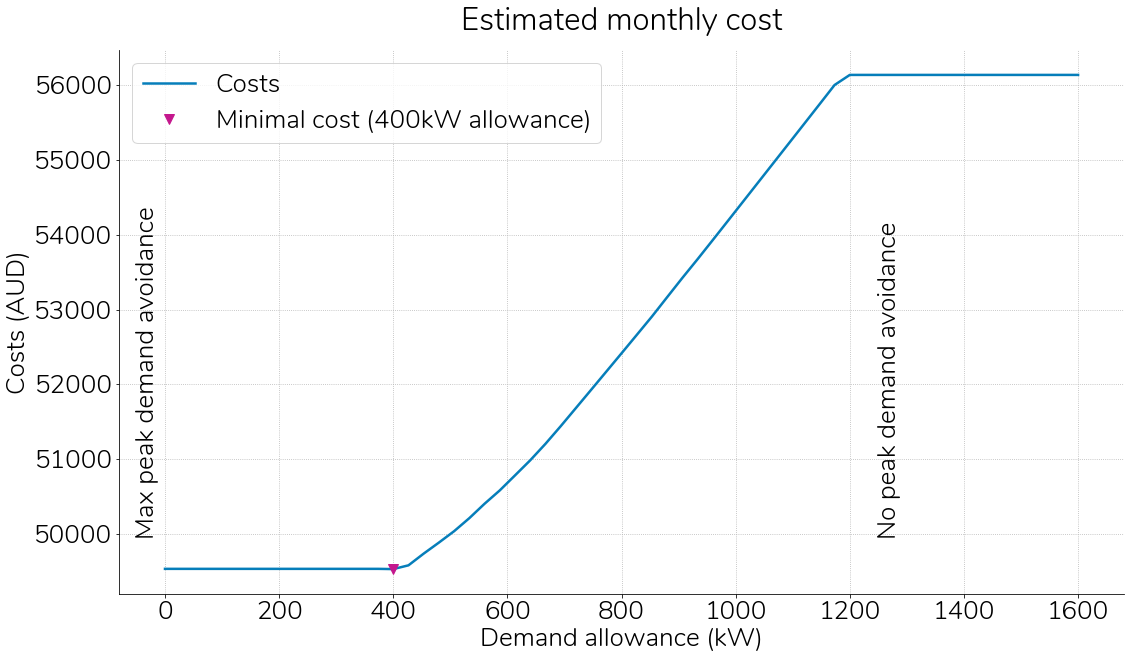

The figure here shows how Evergen optimisation strikes a balance between spot optimisation and demand charge management. We fixed the demand tariff in this example at 33c per kW per day. However, we introduced a new variable called demand allowance, which varies from zero to 1600 (kW). Demand allowance is how much power the optimisation is free to use without incurring demand charges. This variable enables us to control how conservative demand charge management should be. In real-world scenarios, demand allowance can be set based on minimum demand costs or the current maximum demand in the billing cycle, relying on historical data.

On the one hand, if the demand allowance is close to zero, the optimisation will try its best to minimise demand. On the other hand, if it is too high, IC won’t restrict demand for the benefit of spot trading. The results show that we should keep the allowance low (close to 400kW, for this site with a 1MW peak consumption, a 1MWh battery with 500kW of maximum power). In this toy example, optimising against the spot prices can increase demand and create substantial extra charges, up to $6,600 in a single month.

Demand charges represent a significant portion of the electricity bills. In commercial and industrial (C&I) sites, it can easily reach up to 50% of their electricity costs. Consequently, according to recent analyses [1], demand charge reduction may represent 59% of a C&I site’s savings (concerning electricity management). Therefore, co-optimising the use of energy storage to strike the ideal balance between load shifting and demand charge management is imperative.

The myriad of network demand charges makes every case unique. Since each network service provider has its flavour of demand charges, we need the flexibility to set up the optimisation. Evergen Intelligent Control allows for any shape of demand tariff, the specification of power factor and demand allowances (for floor prices and historical performance).

. . .

Evergen has been optimising thousands of batteries for several years. Intelligent Control continues to evolve to make the best use of customers’ batteries and other renewable assets. Its primary purpose is to minimise the cost of electricity, make it free where possible, as we discussed in this blog.. Additionally, it takes care of the batteries by maximising their efficiency and letting customers control their assets’ depth of discharge and degree of cycling.

Distributed energy resources are the future, and Evergen wants our customers to get there faster. Better. Smarter.

References

[1] New Energy Ventures, 2020. Opportunities for Batteries & VPPs in the Australian C&I segment. White Paper. Available at https://www.newenergy.ventures/vppwhitepaper2020